Understanding the Indian Cryptocurrency Market

The Indian cryptocurrency market has rapidly evolved, becoming a significant player in the global digital asset ecosystem. Despite initial skepticism and regulatory uncertainties, the adoption of cryptocurrencies in India has surged, fueled by the country’s young, tech-savvy population and a growing interest in decentralized finance (DeFi).

Bitcoin and Ethereum remain the most popular cryptocurrencies, but Indians are also exploring altcoins and blockchain-based projects. This growth is supported by an increasing number of cryptocurrency exchanges and startups catering to Indian users, offering easy access to buying, selling, and trading digital assets.

With growing investor interest and innovation in Web3 and blockchain-based applications, the future of the Indian cryptocurrency market looks promising, provided there is balanced regulation to foster growth while ensuring consumer protection.

India’s crypto market stands at the cusp of potential, poised to shape the global blockchain narrative with its innovation and vibrant talent pool.

Legal Aspects of How to Buy Cryptocurrency in India

Buying cryptocurrency in India is legal, but it exists within a complex regulatory framework that potential investors must navigate carefully. Currently, there is no outright ban on owning or trading cryptocurrencies, but the lack of dedicated legislation leaves the sector in a gray area.

The Reserve Bank of India (RBI) imposed a banking ban on cryptocurrency transactions in 2018, but this was overturned by the Supreme Court in 2020, allowing Indians to access crypto exchanges and trade freely.

However, in 2022, the government introduced a 30% tax on crypto gains and a 1% TDS (Tax Deducted at Source) on all crypto transactions. These measures clarified that cryptocurrency trading is not illegal but is subject to strict taxation.

Additionally, crypto investments are not regulated like traditional financial instruments, meaning they lack consumer protection. Investors must rely on reputable exchanges and stay updated with compliance requirements, such as declaring gains in their tax filings.

While the government has shown interest in exploring the possibilities of blockchain, private cryptocurrencies remain under scrutiny. Prospective buyers should exercise caution, research thoroughly, and stay informed about new regulations. With proper understanding, buying cryptocurrency in India can be both lawful and rewarding.

Popular cryptocurrencies in India

India has emerged as a hotspot for cryptocurrency enthusiasts, with millions actively exploring the digital asset space. Some of the most popular cryptocurrencies in the country include Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and Binance Coin (BNB).

Bitcoin, often called the “king of crypto,” remains the most sought-after due to its status as the pioneer and store of value. Ethereum comes next, celebrated for its smart contract capabilities and the foundation it provides for decentralized apps (dApps).

Tether, a stablecoin pegged to the US Dollar, has gained traction for those looking for a less volatile option. Binance Coin, tied to the Binance exchange, has also captured interest due to its utility in trading fee discounts and other ecosystem benefits.

In addition to these giants, newer cryptocurrencies like Solana (SOL), Polygon (MATIC), and Cardano (ADA) are becoming household names. Polygon, developed by an Indian team, is particularly favored for its scalable blockchain solutions.

The growing awareness and interest in crypto stem from a tech-savvy population and increasing efforts to simplify crypto adoption. However, regulatory uncertainty remains a challenge, urging investors to stay cautious while exploring this exciting world of digital assets.

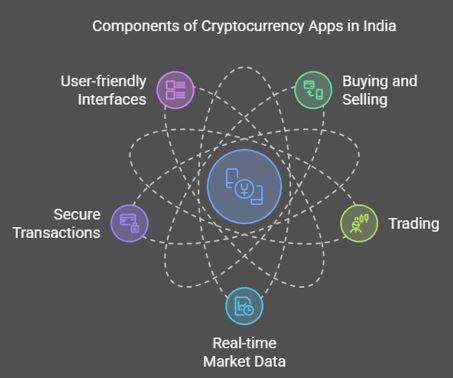

Choosing a Cryptocurrency Exchange Platform

Choosing the right cryptocurrency exchange platform is crucial for a seamless trading experience. Start by assessing security features, as protecting your funds and personal data is a priority. Look for exchanges with two-factor authentication (2FA), encryption, and a strong reputation for reliability.

Next, consider the platform’s ease of use. A beginner-friendly interface and helpful tutorials can make trading less daunting. Evaluate the range of cryptocurrencies offered to ensure they support the coins you’re interested in. Transaction fees are another important factor—compare costs like trading fees, withdrawal fees, and deposit charges.

Payment methods are equally important; choose a platform that supports your preferred method, whether it’s UPI, bank transfer, or credit cards. Regulatory compliance and customer support are additional factors that enhance trust and usability. Finally, check user reviews to get a sense of other traders’ experiences.

Setting up your cryptocurrency wallet

Setting up a cryptocurrency wallet in India is an essential step for securely managing your digital assets. First, decide between a hot wallet (online) or a cold wallet (offline). Hot wallets, like apps or web-based wallets, are convenient for frequent transactions, while cold wallets, such as hardware devices, offer enhanced security for long-term storage.

Start by choosing a reputable wallet provider that supports the cryptocurrencies you plan to use. Popular options include Trust Wallet, MetaMask, and Ledger. Once chosen, download the app set up the hardware wallet, and follow the instructions to create your account.

During setup, you’ll receive a seed phrase—a unique recovery key. Keep this offline and never share it, as it’s the only way to recover your wallet.

After setup, you can fund your wallet by purchasing crypto on exchange and transferring it. Always enable two-factor authentication (2FA) for extra security.

Read more- Cryptocurrency App: A Complete Guide to Choosing and Using Them

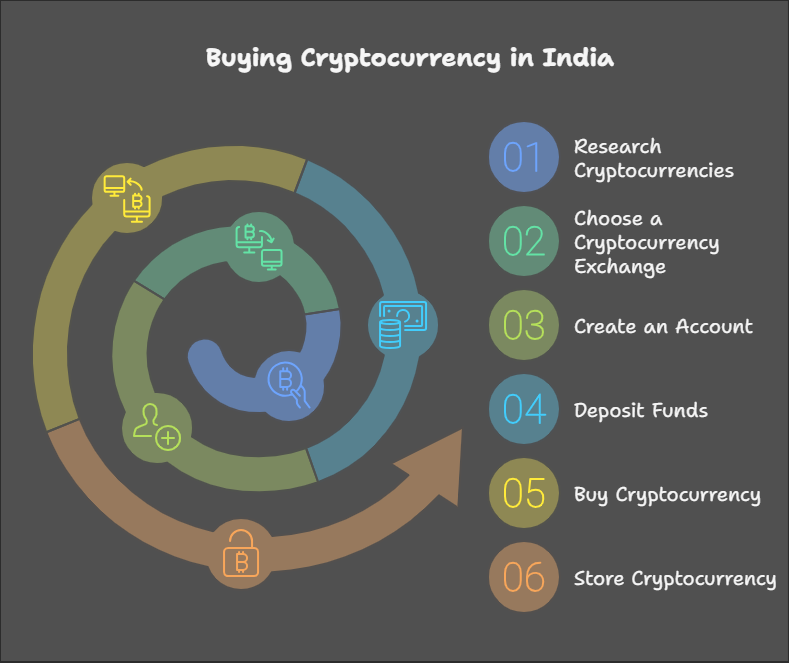

How to buy cryptocurrency in India

Buying cryptocurrency in India is a straightforward process. Start by choosing a reliable cryptocurrency exchange like WazirX, CoinSwitch Kuber, or CoinDCX. These platforms are user-friendly and cater to Indian investors.

Create an account on the exchange by providing basic details and completing the KYC (Know Your Customer) process, which usually requires submitting ID proof like an Aadhaar or PAN card. Once verified, link your bank account or payment method, such as UPI, to the exchange.

After setting up your account, deposit funds into your exchange wallet. Browse the platform to choose the cryptocurrency you want to buy, such as Bitcoin (BTC), Ethereum (ETH), or others. Specify the amount, review the transaction, and confirm your purchase. Your crypto will appear in your exchange wallet instantly.

Remember to transfer your holdings to a secure wallet for safety.

Security measures for buying and storing cryptocurrency

When buying and storing cryptocurrency in India, security is key to protecting your digital assets. Start by choosing a reliable and secure cryptocurrency exchange, such as WazirX, CoinDCX, or CoinSwitch Kuber, with strong security features like two-factor authentication (2FA) and encryption. Always enable 2FA to add an extra layer of protection to your account.

Read More- Ultimate Guide to Cryptocurrency Platforms In India

When making transactions, use secure and private internet connections, avoiding public Wi-Fi, as it can expose your data to hackers. Be cautious of phishing attempts—verify URLs before entering your credentials and never share sensitive information like your wallet’s seed phrase.

After purchasing cryptocurrency, transfer your funds to a personal wallet instead of leaving them on the exchange. Use a hardware wallet like Ledger or Trezor for long-term storage, as these are offline and immune to online hacks. For smaller amounts or frequent transactions, opt for a trusted software wallet, such as Trust Wallet or MetaMask.

Regularly back up your wallet and store your seed phrase securely, offline, and in multiple locations. Stay updated on security practices and ensure your devices are protected with antivirus software.

By prioritizing these measures, you can confidently explore the exciting world of cryptocurrencies in India.

Conclusion and future of cryptocurrency in India

The future of cryptocurrency in India is both promising and challenging, as the country finds itself at the crossroads of innovation and regulation. Cryptocurrencies have already captured the interest of millions of Indians, with Bitcoin, Ethereum, and emerging coins like Polygon gaining widespread adoption.

The younger, tech-savvy generation, coupled with India’s booming digital economy, has paved the way for blockchain technology and cryptocurrencies to flourish. However, the regulatory landscape remains uncertain.

Despite regulatory hurdles, cryptocurrencies hold immense potential to transform how Indians interact with money. They offer financial inclusion, enabling access to banking services for the unbanked, cross-border payments with reduced fees, and opportunities to participate in the global decentralized economy.

As awareness grows and regulations mature, India is likely to become a significant player in the global crypto market. The future lies in fostering collaboration between the government, tech innovators, and users to ensure a balanced, secure, and thriving crypto ecosystem.