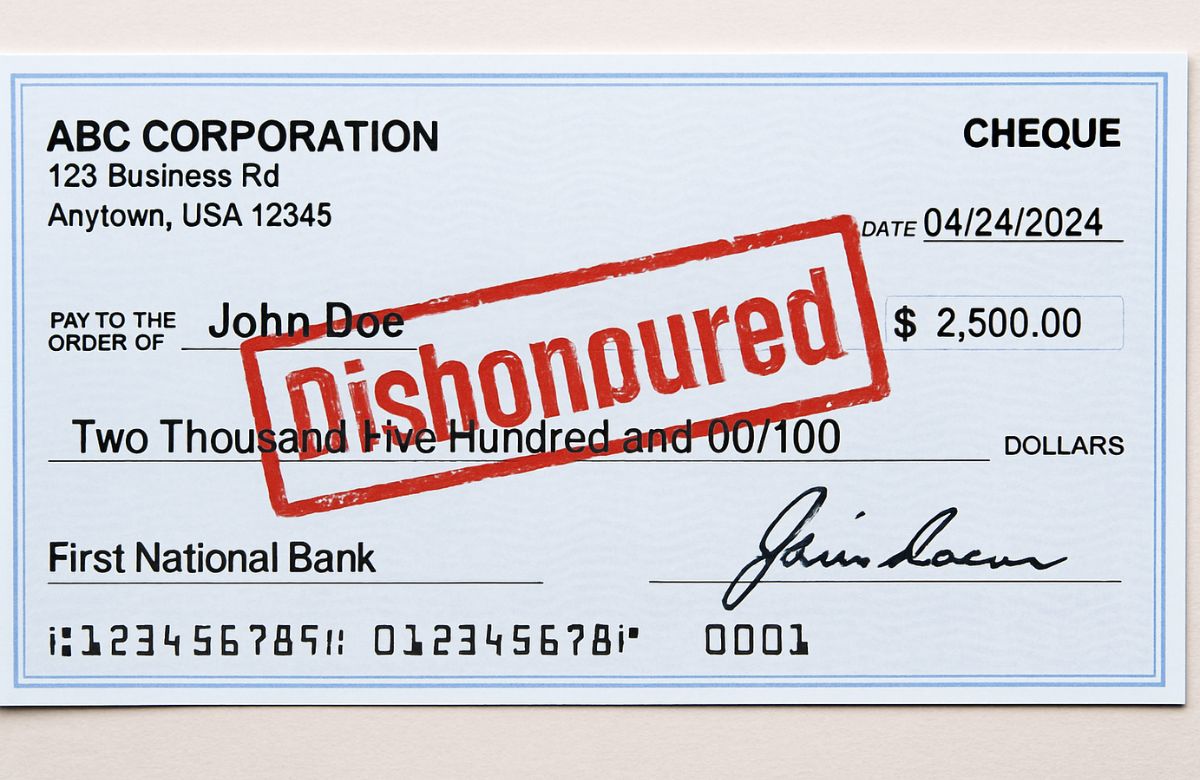

If a cheque issued for a large payment ends up bouncing, the consequences in 2025 are much tougher than ever before in India. The rules for cheque bounce cases were updated from April 1, making it easier to spot fraud and defend the rights of the payee.

These new rules are relevant to anyone who either gives or receives cheques—individuals and businesses must take note

The latest amendments aim to discourage people from intentionally causing cheques to bounce. Earlier, offenders could be jailed for up to one year; now, the punishment can extend to two years in jail or a fine that can be as much as twice the cheque amount.

This makes the consequences much more severe for defaulters. However, if a cheque bounces due to technical issues or genuine banking mistakes, the law still allows relief for those who made honest errors.

Simplified Complaint Process and Faster Justice

Filing a complaint about a bounced cheque is now more convenient. The option to file complaints online speeds up the process and reduces paperwork. People must get the bank’s cheque return memo within 30 days and can then quickly move through the legal steps.

Cases that previously dragged on for months or years now aim to be resolved within 90 days by dedicated courts.

Increased Bank Responsibility and Digital Notices

Banks have to respond faster—both the payee and account holder receive SMS or email alerts within 24 hours explaining why the cheque bounced. Banks also update the RBI about bounced cheques, helping track habitual defaulters. Digital legal notices (by email or SMS) are accepted in court as valid proof, making the process more streamlined and paperless.

Actions Against Repeat Defaulters and Account Freezing

If a person’s cheques bounce three times, banks have the authority to freeze their accounts temporarily. This move is designed to prevent repeat offenses and ensure financial discipline. The penalty rules are also now consistent across banks, targeting fraud and protecting payee interests.